“Get full detailed explanation of the new GST rule applied on Selling or Purchasing a Old or Refurbished Car in India”

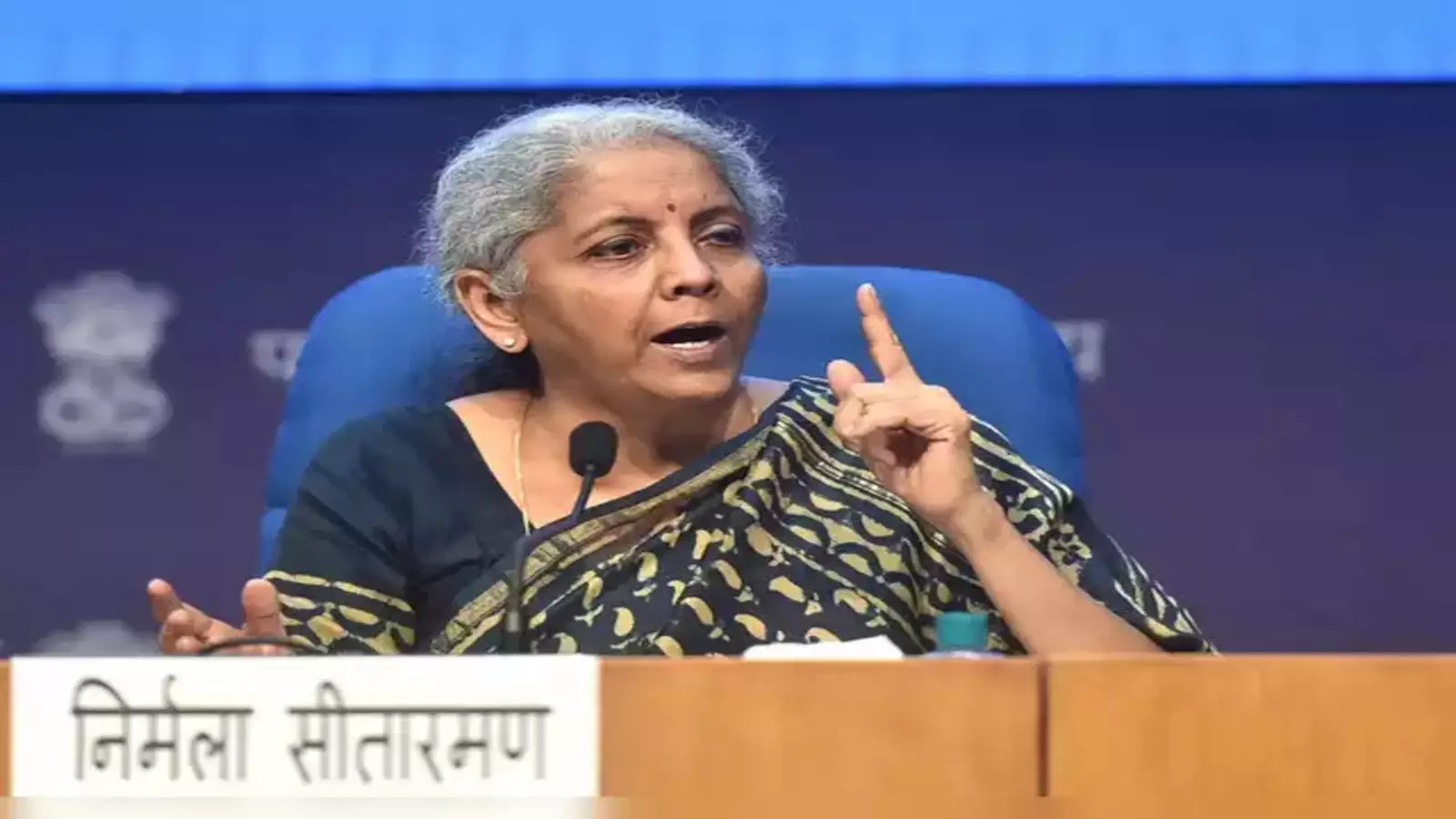

Our Finance Minister Nirmala Sitharaman had recently announced that there will be an increase in the Goods and Services Tax (GST) is going to be applied on the sale of used vehicles which will varies from 12% to 18%. This change applies specifically to the sales conducted by dealers and businesses; but here there is no change for individual-to-individual transactions they remain unaffected from this new rule.

- The new GST rule is applied for used cars which applies an 18% tax on the profit margin that is earned by registered dealers instead of the full resale price. This means GST is going to be calculated on the bases of the difference between the price on which the dealer bought the car and For the price they are going to sell at.

- Important to note that this GST adjustmentis not going to impact individual sellers. When a private individual try to sell a used car to an another individual, There will no GST is applied to the transaction. This measure is aiming to the standard taxation across all the different types of used vehicles, which is also going to including electric vehicles, within the formal resale market.

- Let’s understand it with a example

- The Dealer is purchasing a car at a price of 5L /-

Purchase Price (by Dealer): ₹5,00,000

- And the same dealer sells the car at a price of 6L /-

Resale Price (to Customer): ₹6,00,000

- The Difference between the purchasing price and the selling price is Rs. 1L /-

Margin: ₹6,00,000 - ₹5,00,000 = ₹1,00,000

- Now here , There will a tax of 18% will be applied on the dealer on the difference amount which can be also called as the profit of the business

GST at 18%: ₹1,00,000 × 18% = ₹18,000

The dealer adds ₹18,000 as GST on the profit margin, bringing the total transaction price for the buyer to ₹6,18,000.

NOTE - The GST tax will not applicable on the loss making sector this tax will be only applicable for Profit making Sector.

Why This Change is Required ?

- Standardization: This move is going creates a uniform tax framework for all types of vehicles, including electric and hybrid models.

Encouragement for Formal Sector Transactions: By taxing only the margin, the government incentivizes dealers to report transactions accurately, reducing black-market activities.

- Clarity of Dealers: The profit-linked tax structure provides better transparency, aligning with global best practices.

- GST Paid on Margin, Not Original Value:This ensures fairness since older cars with a higher purchase price but lower resale value won't attract disproportionate tax amounts.

- Global Standardization:This margin-based GST structure aligns India’s tax system with international practices, making it more consistent with global standards.

More News: celebrity news and gossip

Conclusion

By applying GST only on the dealer's profit margin, the government ensures that taxes are levied fairly, without burdening both dealers and buyers.

- Whether you're a dealer, buyer, or seller, understanding the new GST rule is crucial for making informed decisions in the used car market.

- On the other hand, private sales remain free from GST, offering individuals an easier and more affordable way to sell their vehicles.

- this introduction of the new GST rule for used cars marks a significant step towards simplifying the taxation system while ensuring fairness and transparency.

Explore other popular Posts:

Blog | News | Entertainment | Education | Sports |

Technology | Cryptocurrency | Stock | Home | Sitemap